The consistent, bold investment Boulder has made in smart growth for over a century has preserved and enhanced the city’s natural charm, and appeal.

This beauty makes Boulder a glorious place to live and work. It also makes the city a real estate pressure-cooker, as its allure surges with an ever-growing tech-hub reputation and growing, smart workforce that burnishes an already standout Flatiron charm to a high sheen.

Larger investors, institutional and private equity, are taking notice.

There’s no easy way to catalogue local commercial ownership and how it may be changing, but the experience of one property owner, PMD Realty — which owns, and has proposed a redevelopment of the now-vacant Old Chicago building on the Pearl Street Mall — several recent property sales and those familiar with downtown’s commercial economics suggest change is afoot.

“We’re seeing a change” in the local character of downtown commercial property ownership, says Phil Day, principal at local property investment firm PMD Realty, which owns a dozen area commercial and residential properties, all but two in Boulder. (Day is the son of noted Boulder restaurateur Frank Day.)

Todd Walsh, principal broker at Boulder commercial real estate brokerage Boom Properties, has the same take. Institutional money, such as the $39.4 million JPMorgan Chase paid for the Canyon Center (at 1881 9th Street in Boulder) in May, is not dumb money, he explained.

Rather than maximizing profits as out of town investors tend to do, local owners tend to have a more stable, long-term, relationship-focused approach to ownership, Walsh told BLDRfly.

As Boulder commercial property values — and development fees and taxes — shoot up, smaller local owners, and their renters, feel the squeeze, contributing to a growing prevalence of larger, often non-local owners and retailers, and higher prices and diminished local character for Boulder residents and visitors.

The effects of this boiling local economy are already playing out.

Property value, and rate, increases have pushed some local retailers out of town — such as Perry’s Shoe Shop, who decided to relocate to Nederland this year when it learned its monthly rent at 1711 15th St. was set to more than double (to approximately $9,000) when its lease ended in two years — and left high-profile vacancies on ground-floor retail space on the Pearl Street Mall.

Rising commercial values changing Boulder character

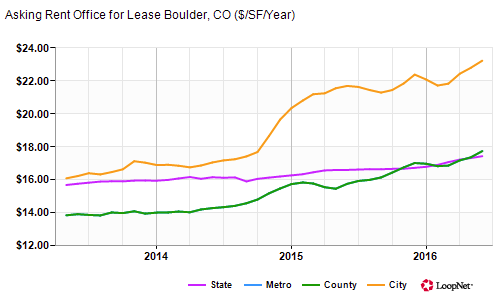

Boulder commercial real estate values are rising. From mid-2014 to mid-2016 per-square-foot office lease rates jumped more than a third, from approximately $17 to $23, according to LoopNet data. Downtown Boulder, with Pearl Street Mall as an epicenter, plays a big role.

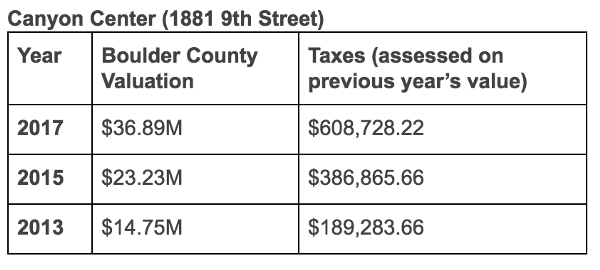

The Canyon Center at 1881 9th Street illustrates this value jump, and the institutional investor presence in Boulder commercial real estate.

New York City-based multinational The Blackstone Group bought the 73,125-square-foot building in December 2016 for $32.9 million, part of $92.6 million the multinational public company spent on three Boulder downtown buildings that month, and flipped it in May for $39.4 million when it sold to JPMorgan Chase & Co., according to a LoopNet report.

Aside from the higher sale price, Boulder County Assessor’s office valued the property at $36.9 million this year, a 150 percent jump from its 2013 valuation of $14.8 million. The taxes over that period jumped over 220 percent to $608,728.22 in 2017.

With values — and taxes — jumping that high in Boulder and downtown in particular, Boulder may be entering a new era of ownership, when prominent local owners such as Stephen Tebo and J Nold Midyette, and smaller ones such as PMD Realty, become less prevalent.

Midyette, in fact, sold a majority stake of his 15-property downtown Boulder property portfolio to Seattle-based Unico Properties in 2015. That same year, Unico made perhaps the biggest single commercial purchase in Boulder’s history in 2015 when it purchased more than 1 million square feet of office space in four east Boulder office developments for $168 million.

The city is well aware of the changes, and challenges, in maintaining a unique downtown character amid changing economics.

In February, Boulder City Council instituted a surprise ban on banks taking ground-floor space on Pearl Street Mall between Ninth and 18th streets, and then updated it in May, requiring banks considering a downtown move to undergo a special use review, which gives the city additional tools to shape downtown’s business mix.

“The concern is that smaller and local businesses are being priced out,” Boulder Mayor Suzanne Jones said in a May Daily Camera piece about the revised bank plan.

The revised downtown bank rule didn’t stop Oklahoma City-based bank MidFirst from purchasing 840 Pearl St. for $2.4 million this summer with plans to open a branch after remodeling.

Former owner, locally-owned copy center Eight Days a Week, which has been downtown for over 40 years, sold the over 4,000-square-foot office space.

Old Chicago, new Boulder

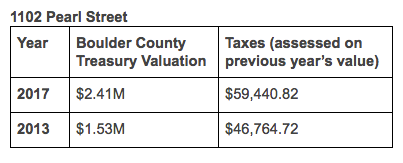

PMD Realty owns 1102 Pearl Street, a prominent corner on the Pearl Street Mall’s west end and site of the original Old Chicago Restaurant that Frank Day opened 41 years ago. Old Chicago vacated the property this January.

Sign up for BLDRfly's newsletter

PMD’s effort to redevelop the site provides a window into the challenge Boulder faces around maintaining local character and sustainable growth as values float higher and demand from larger, institutional investors swells.

The firm proposes to raze the existing, one-story 5,000-plus-square-foot building and replace it with a three-story, 15,380-square-foot development with ground-floor retail, second-floor office space and third-floor residential units.

Evolution of the building’s design, Sept. 2016, March 2017, May 2017 (left to right, respectively). After receiving some encouragement from the Landmarks Board, PMD is coming back with a modified version of the first — among the changes are a chamfered corner.

The idea to redevelop the property emerged over two years ago when Old Chicago notified the firm that it planned to vacate, Phil Day told BLDRfly. At that time, PMD contacted its architect, and had its first meeting with the city about the proposed redevelopment in May 2016.

Over a year in, the project’s still in front of the Boulder Landmarks Board, which helps ensure new developments — especially those in a high-profile area like the Pearl Street Mall — align with established city building guidelines.

The board will review a new, slightly modified design featuring a set-back third story and camphored corner this Wednesday. If approved, the development faces the next steps: a site review by Boulder city staff, which takes approximately three months; review of documents by the planning board, which takes approximately two months; building permit application, which takes approximately three months.

If all goes smoothly, construction would begin next May and be completed a year later, May 2019, three years after PMD kicked off the process.

This is a long timeline, but as Boulder City Councilmember Bob Yates told BLDRfly: The city values a slow, public process. “We would rather be careful, deliberate and transparent with lots of public participation,” he added.

The city rightfully has stringent development rules for downtown Boulder, especially for a building on the bricks, the city’s most public face.

This creates challenges for owners, especially local owners, as they have less operating revenue buffer, shorter horizons and different economics to play with.

The entitlement fees associated with getting PMD’s proposed new building approved and built will account for approximately 15 percent of the project’s $5 million anticipated construction costs, according to Jesse Day, Phil Day’s son who also helps run PMD Realty.

“We’ll have to charge the highest level rents to make the pro forma work,” Day told BLDRfly. “It barely works.”

PMD Realty will have to swallow its monthly $5,000 property taxes while it remains empty for more than two years. Temporary pop-up shops will offset some of that cost.

Taxes play a role, too.

The property’s assessed value jumped 57.5 percent between 2013 and 2017, and property taxes rose 27.1 percent over the same period. (Note: taxes in a particular year are built off the previous year’s property value).

Downtown owners recoup taxes and operating expenses from tenants through Triple Net rents. That means as expenses and taxes rise, owners struggle to attract tenants who can pay rents that help the bottom line; those can can are rarely local. This is happening in PMD’s case.

PMD and other local owners win when and if they sell to well-heeled outside investors at the high valuations sustained by the economics of longer horizons and the ability to absorb higher near-term costs.

However, increased outside ownership jeopardizes Boulder’s local soul. The Old Chicago redevelopment is just one facet in Boulder’s growing commercial appeal and the tricky development-slow-growth dance Boulder must execute if it wants to continue growing smart while staying local.

Disclosure: BLDRfly’s headquarters are at Niche Workspaces, which is owned by PMD Realty.